This lender presents competitive premiums — in the event you’re an current consumer and also have strong credit history. Citibank doesn’t present prequalification, so that you’ll must post a proper software for getting an idea of the mortgage conditions.

Total a simple on the web type to request cash. Upon acceptance, the money is distributed directly to your picked checking account.

Acorn Finance supplies a time-saving platform that can hook up you with various individualized personalized bank loan presents.

The prolonged-phrase expenses of the $two,000 bank loan will differ determined by your curiosity level, charges and repayment conditions. The lessen your rate and charges, the lesser your expenditures of borrowing might be.

LendingPoint considers personalized personal loan applicants with honest credit rating, but You could have to pay high desire costs and fees that may consume into your Preliminary bank loan amount. There’s also an earnings prerequisite to qualify, and cosigners aren’t authorized.

If you have bad credit, look for lenders offering prequalification — this can present you with an idea of the conditions you may be presented prior to deciding to commit, without challenging inquiry which will briefly deliver your scores down further more.

This answer was initial revealed on 05/seventeen/18. For essentially the most recent specifics of a economical product or service, you must always Test and confirm accuracy While using the offering money institution. Editorial and read more user-created content will not be supplied, reviewed or endorsed by any business.

Critical Specifics:Avant personalized loans really are a solid selection for honest- and bad-credit borrowers who want quick funding, but their rates and origination expenses may be superior.

Every month payments. Critique what your monthly payments are going to be on Every single personal loan offer you to be certain they suit your spending plan.

Late Or Non-Payment Implications By accepting the conditions and terms for a private mortgage, you fundamentally comply with repay the personal loan the two: 1) with curiosity and a couple of) in the timeframe specified in the financial loan arrangement. Most often, failure to repay the financial loan in total, or building a late payment, may end up in additional fees.

She begun her profession for a author for publications that coated the home finance loan, grocery store and cafe industries. Kim attained a bachelor's diploma in journalism in the University of Iowa along with a Master of Company Administration in the College of Washington.

Regardless of regardless of whether an establishment or Specialist is a paid out advertiser, the existence of information on WalletHub does not constitute a referral or endorsement in the establishment or Experienced by us or vice versa.

Break up payments. Payment splitting consists of shelling out fifty percent of your payment each 15 times — rather then every thirty days. This allows you to sync payments up using a bimonthly pay out routine and conserve on curiosity by lowering your equilibrium during the 2nd 50 percent on the thirty day period.

LendUp's Suggestion: Be careful for predatory lenders providing "assured approval." These loans may possibly feature concealed fees, sky-higher APRs (about a hundred%), or conditions that entice you in personal debt. Normally verify the lender is licensed inside your condition and skim assessments to stop ripoffs.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Richard "Little Hercules" Sandrak Then & Now!

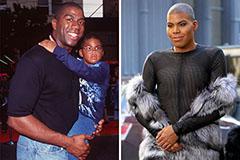

Richard "Little Hercules" Sandrak Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!